by John Harbison, Chairman Emeritus of Tech Coast Angels

(originally published by the Angel Capital Association in their Data Insights Series)

Early-Stage investing is inherently cyclical, and for the first time in over a decade we are experiencing a downcycle. An important question leaps out: Is it better to invest more or less during a downcycle?

Conventional wisdom suggests that companies receiving initial investment during a downcycle should do better than companies receiving initial funding during upcycles. This is presumably because the hurdle for receiving investment is higher (meaning the companies are better) and competitors are less likely to get funding (or at least there is a head start over those competitors that take longer to get funding).

But is that conclusion supported by data? Apparently not – let’s go over the analysis.

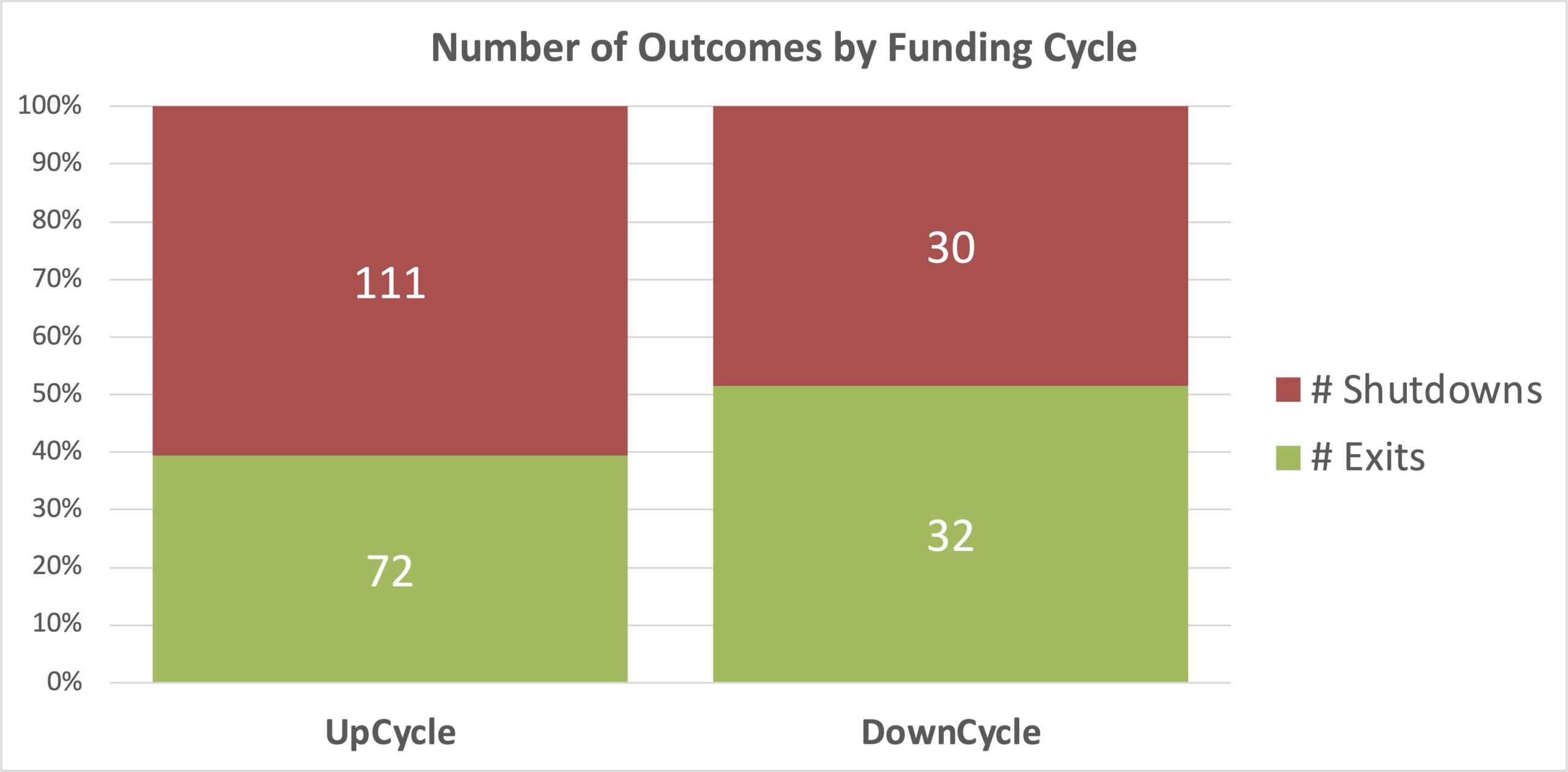

To answer this question, we look at data from Tech Coast Angels. TCA has invested in 520 companies since 1997 and had 247 “outcomes” with 106 returning some cash (but only 79 of these returned more than the amount invested). 25% of those outcomes were initially funded during downcycle years (2001-2003 and 2008-2011) with the rest during the upcycles. If you had invested an equal amount in all 247 of those outcomes, your return would be 6.3x. But what does this data set say about returns by (up or down) cycle?

A higher percentage of companies receiving initial funding during downcycles eventually reached exits compared to those initially funded during upcycles – 52% vs 39%. At face value, this supports the conventional wisdom that it is better to invest during downcycles:

Source: Analysis of 247 Tech Coast Angel Outcomes (Exits and Shutdowns) 1997-2022

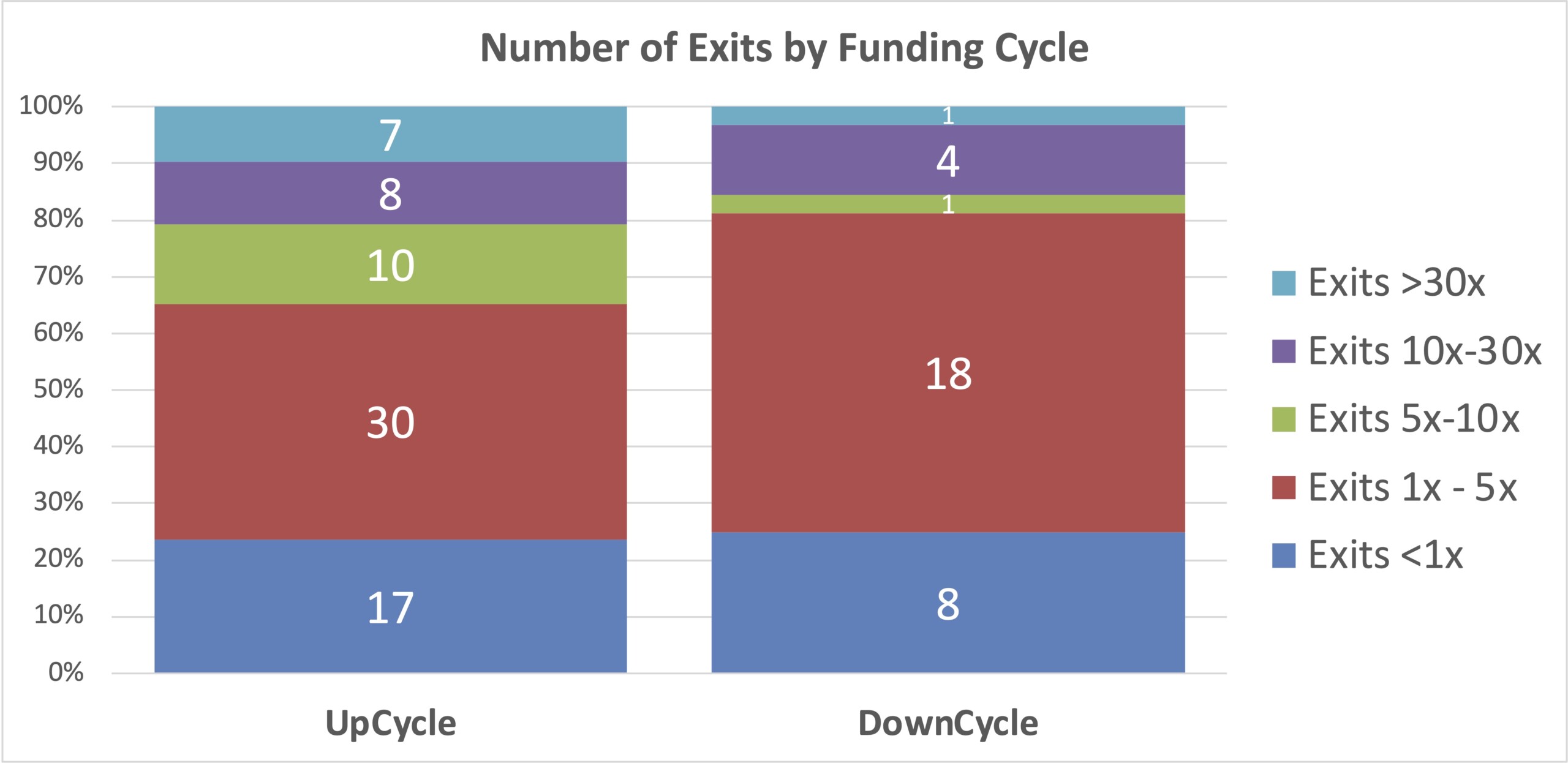

However, those exits from the downcycle companies seem to be much less likely to become big home runs and realize outsized multiples:

Source: Analysis of 247 Tech Coast Angel Outcomes (Exits and Shutdowns) 1997-2022

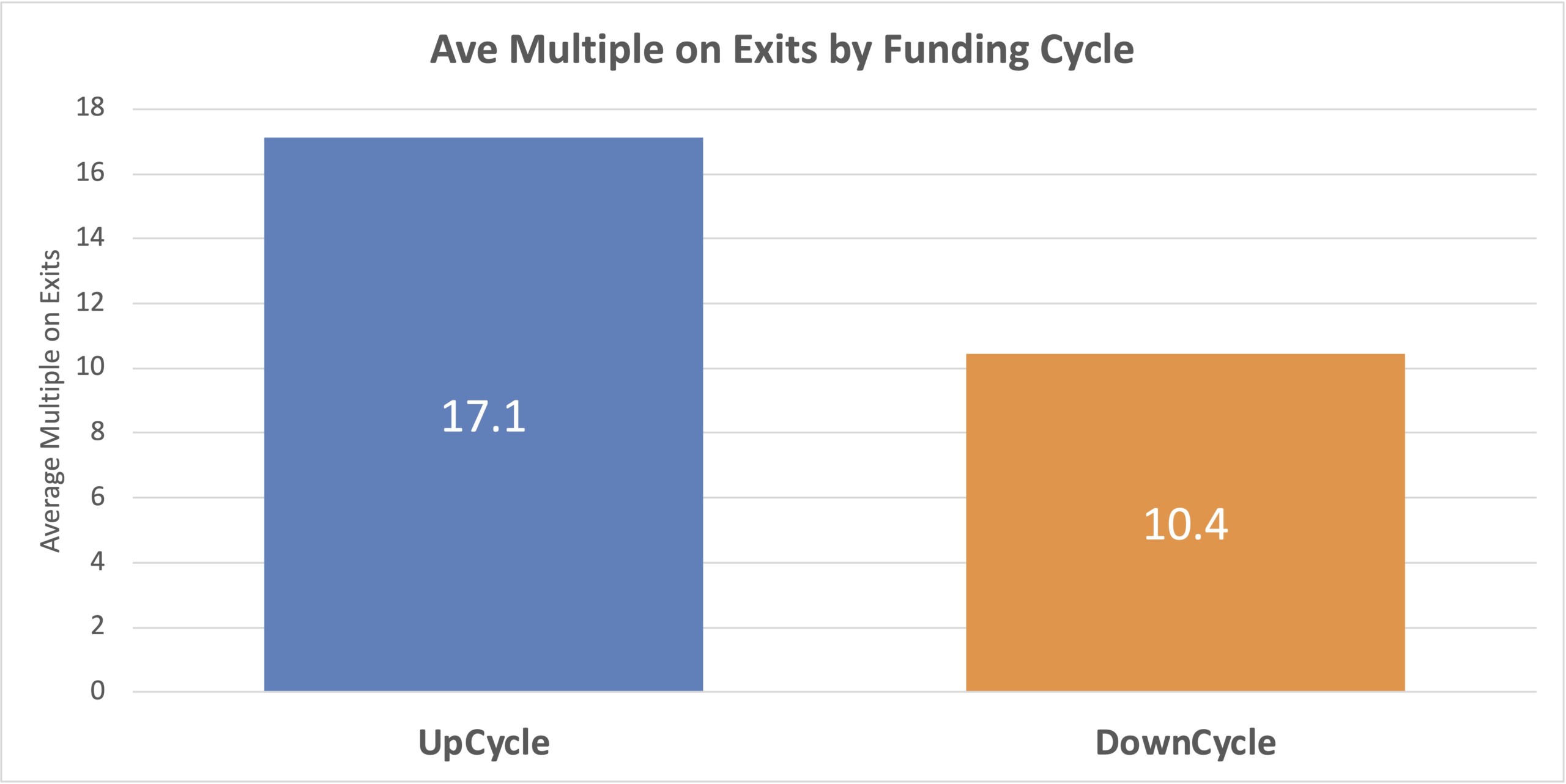

As a result, the average cash-on-cash multiple realized for exits of companies born during the upcycle is dramatically higher – 17x for exits of companies initially funded during upcycles and 10x for companies initially funded during downcycles:

Source: Analysis of 247 Tech Coast Angel Outcomes (Exits and Shutdowns) 1997-2022

Even after factoring in the greater percentage of shutdowns in the upcycle group, average cash-on-cash multiple realized for upcycle outcomes (exits + shutdowns) is higher – 6.7x for outcomes of companies initially funded during upcycles and 5.4x for companies initially funded during downcycles:

Source: Analysis of 247 Tech Coast Angel Outcomes (Exits and Shutdowns) 1997-2022

Another interesting insight is that the time to shutdown for the companies initially funded during downcycles is more than twice as long (5.3 vs 2.5 months) compared to the upcycle group. The time to exit is also longer for the companies initially funded during downcycles butit is not as big a difference (6.5 vs 4.9 months). This longer time to outcomes for companies funded during downcycles is perhaps because their traction is slower in a funding constrained environment, or they last longer because they are of necessity more frugal, plus it takes a while for markets to turn so that exits become more plentiful. For the companies initially funded during upcycles, exits come faster because markets are already more receptive to M&A or IPOs.

Source: Analysis of 247 Tech Coast Angel Outcomes (Exits and Shutdowns) 1997-2022

Why might the data show this? Perhaps it is because valuations didn’t drop enough during downcycles. Or perhaps during the downturns, investors were especially cautious and risk averse, and that translated into avoidance of the highest risk ventures that might eventually deliver the highest returns. Or it could be that TCA was just “unlucky” and only one of TCA’s six exits realizing the highest returns (58x – 368x) fell during those downcycle funding years. Hopefully, we will get a clearer picture when more angel groups that have been around for decades publish similar analysis on their own portfolios, since while 247 outcomes is a large portfolio, the outsized influence of a few grand slam exits may result in errant conclusions. But in the meantime, the TCA data gives us reason to reconsider our assumptions.

A final consideration is that in the current downcycle, valuations of seed stage companies have not fallen as dramatically as later-stage companies and public markets. In previous cycles, the valuation correction was greater. That difference might also have a dampening effect on the ultimate returns from the current crop of companies being funded.

KEY TAKEAWAYS

- Investments in the downcycle may be more likely to reach an exit, but the lower multiples for those exits compared to companies initially funded during the upcycle make the overall multiple realized on a portfolio less for the downcycle ones

- When investing in a downcycle, expectations should be that it will take longer to reach exits, as well as longer for shutdowns to occur

- Valuations remaining at relatively high levels despite the downcycle might further constrain returns