By John Harbison, Chairman Emeritus, Tech Coast Angels

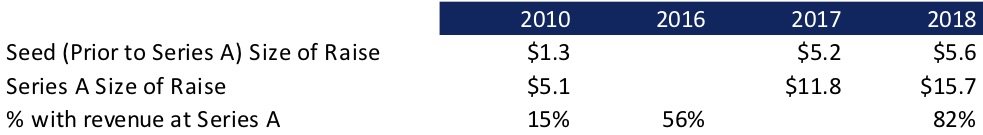

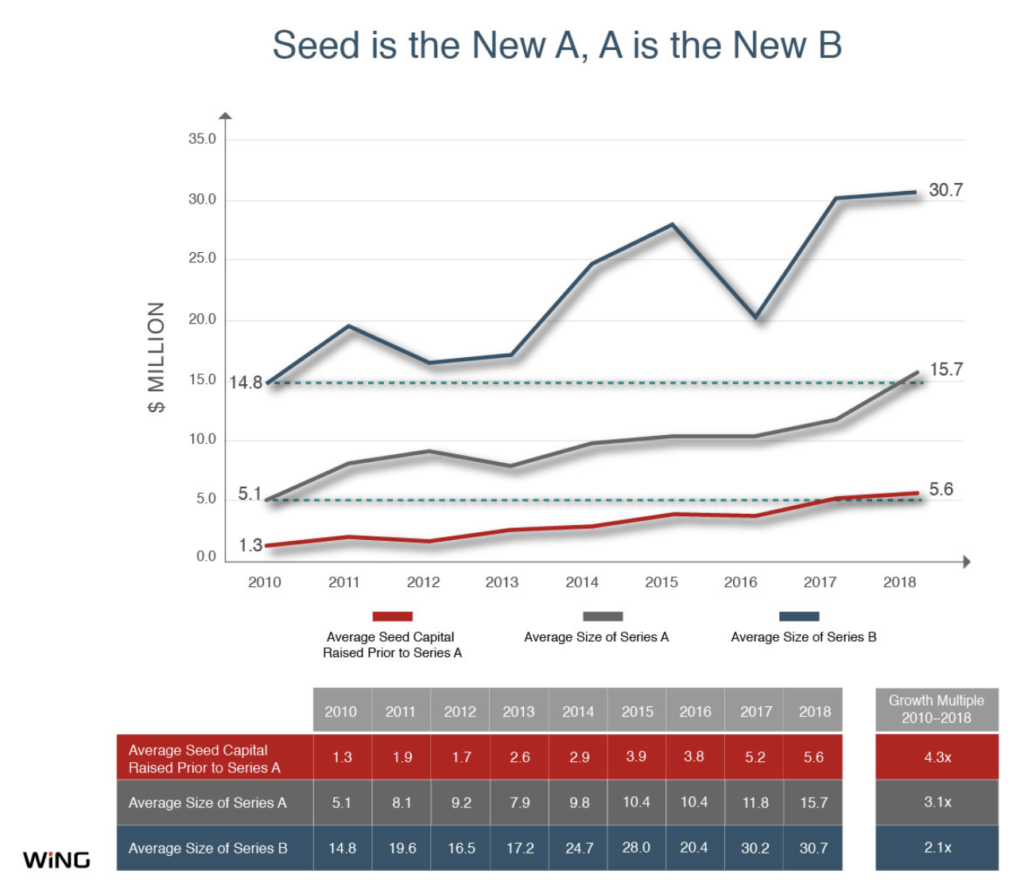

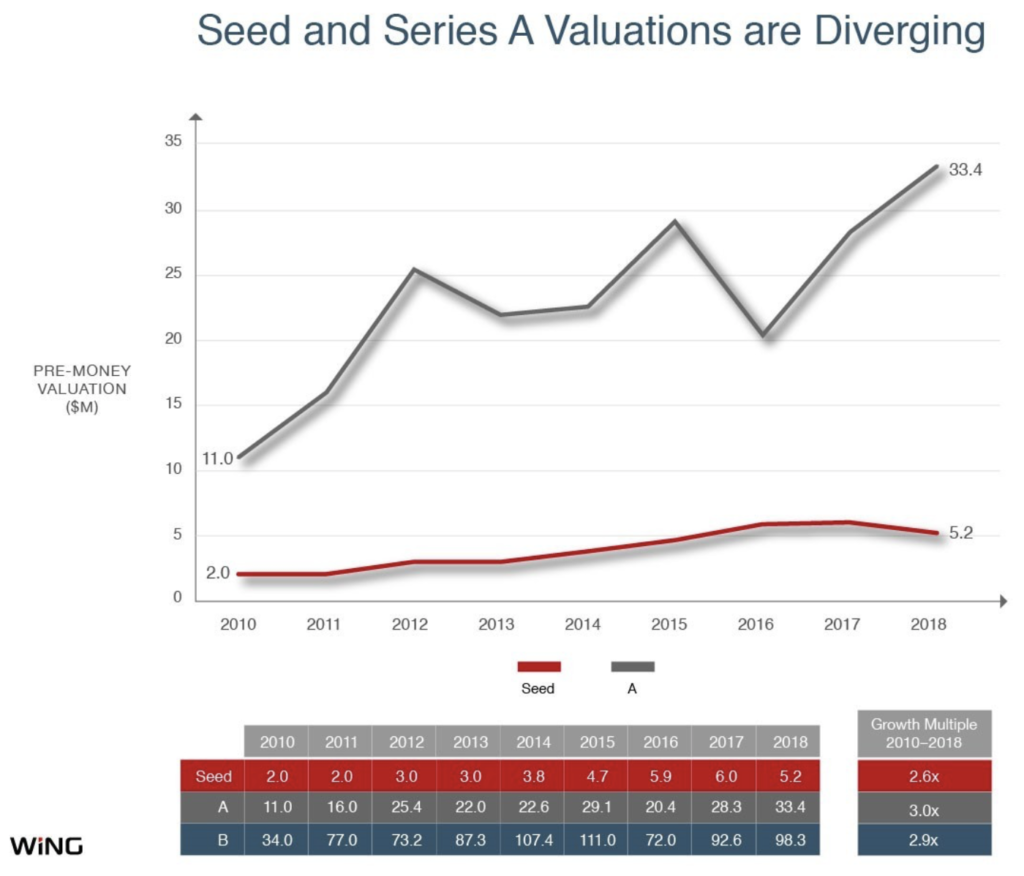

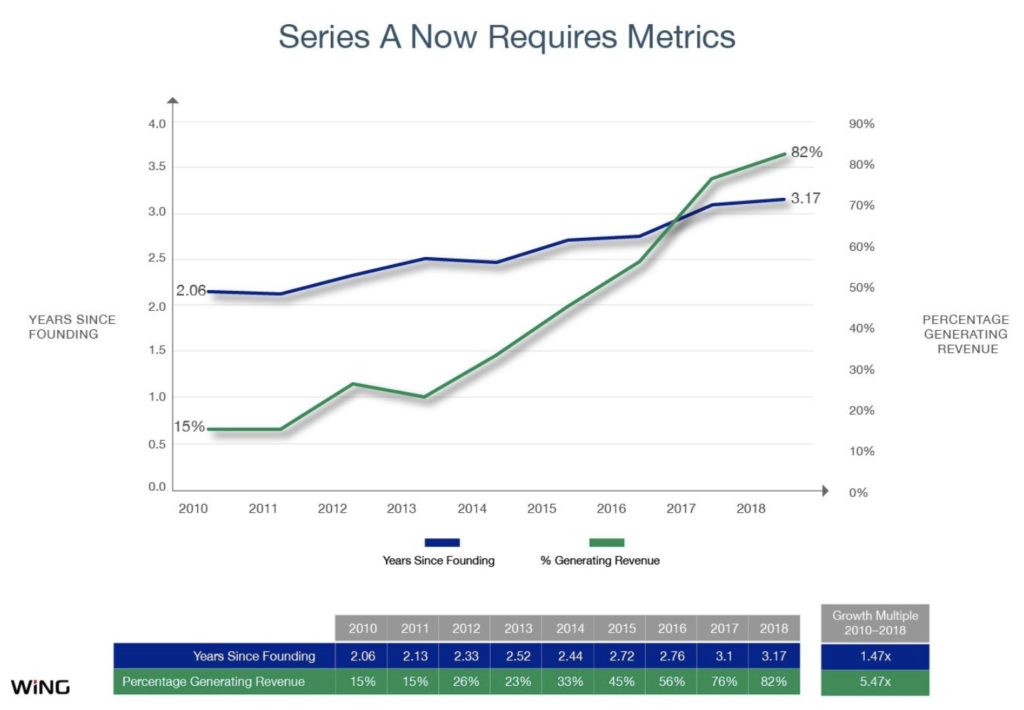

More money is being raised before Series A, and companies which receive Series A rounds are further along in terms of being in revenue and are raising significantly larger rounds at higher valuations.

That is the conclusion of Wing, an eight-year-old, Silicon Valley venture firm co-founded by veteran VCs Peter Wagner and Gaurav Garg, produced some interesting research as reported recently in TechCrunch (click here). For the full Wing study, click here.

They have confirmed some trends that has been evident for much of the past decade. Here is the data as reported by Wing:

This has important implications for angel investors. As TechCrunch states: “Whereas angel investing was long a more casual endeavor, often for operators with other pursuits, the burden is now on seed-stage investors and funds to not only handle due diligence, help with early hiring and find early syndicate partners, but to whip their portfolio companies into fighting, revenue-generating shape, as well.”

We encourage you to check out the full study on Wing’s website — click here.