By John Harbison, TCA Chairman Emeritus

(originally published by the Angel Capital Association in their Data Insights Series)

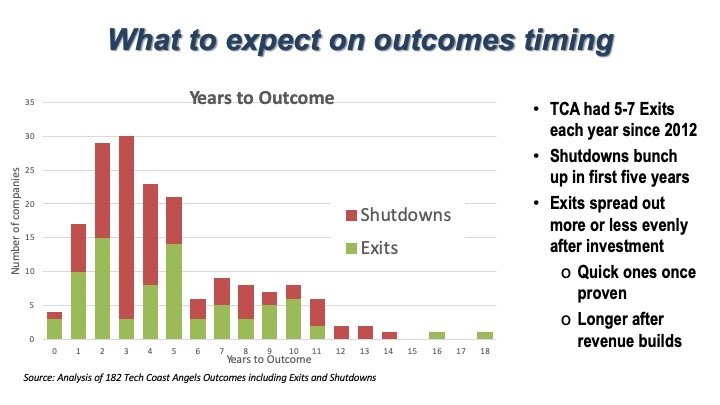

As one gets into angel investment, it is important to have realistic expectations on how long it takes to see exits, and what kind of pattern or mix of exits and failures is typical of a diversified angel investment portfolio.

Based on analysis of 182 outcomes in Tech Coast Angels’ portfolio since 1997, shutdowns tend to bunch up in the first five years as they fail to gain sufficient traction and run out of funding. In contrast, exits are spread out more evenly over a longer period.

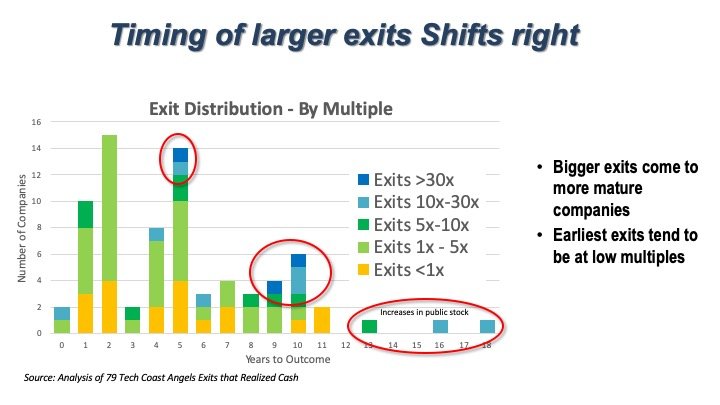

Looking more closely at the exits, the bigger exits tend to come later as they have built significant revenues and are more mature.

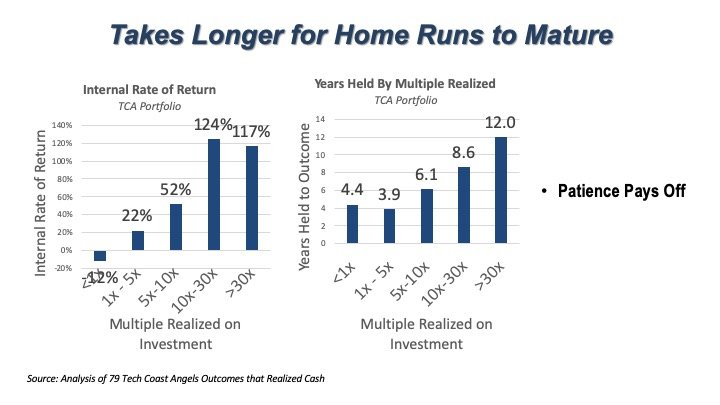

This is particularly true of “home runs”, which typically take 8-10 years (or more) to mature to a successful exit. Earlier exits are rarely at large multiples of the amount invested.

Even though these home runs take longer to mature, the IRR is also typically higher for these later exits.

The consequence is that patience is required since it takes about 5 years to cumulatively earn back the entire investment in the portfolio, even though overall returns can be much higher in the long run – in this instance of TCA’s portfolio, 4.8x realized after 10 years.

So the key takeaway is ANGEL INVESTING REQUIRES PATIENCE. Don’t be too discouraged if the early outcomes you realize as an angel are disappointing – it takes time to build a portfolio, and even more time to start seeing positive returns.