by John Harbison, TCA Venture Group Chairman Emeritus

(originally published by the Angel Capital Association in their Data Insights Series)

In conducting due diligence for early stage companies, we often consider a company’s portfolio of patents and/or patents pending. If the idea behind the company is compelling, most likely there will be competitors and we’d like to understand what (if any) barriers the company has to such competition. Patents are an obvious potential barrier.

But do they really matter? After all, some patents can be worked around, and others which are relevant end up having little value unless the company is prepared to defend them, and has the resources to do that. In a classic example, in the late 19th century, Westinghouse Electric had partnered with Nicholas Tesla who held the patents on AC electricity while Edison General Electric had the patents on DC electricity. When it became clear in 1890 that AC was the winner, GE (which was backed by JP Morgan) just ignored Westinghouse/Tesla’s patents and launched an AC electric business, knowing that GE had much deeper pockets (through JP Morgan) and Westinghouse lacked the resources to litigate. Westinghouse never recovered and GE prevailed in the marketplace.

To answer the question concerning the importance of patents, TCA Venture Group analyzed its 281 outcomes (Exits and Shutdowns) since being founded in 1997. While it is certainly possible to build a successful company without patents, the probability of an exit is higher with patents, and the probability increases with the number of patents in the portfolio. For TCA VG portfolio companies with more than 30 patents, the probability of an exit exceeded 80%:

Figure 1: Patents Increase Probability of Exits

Source: Pitchbook (for patent info) and Analysis of TCA Venture Group portfolio 1997-202

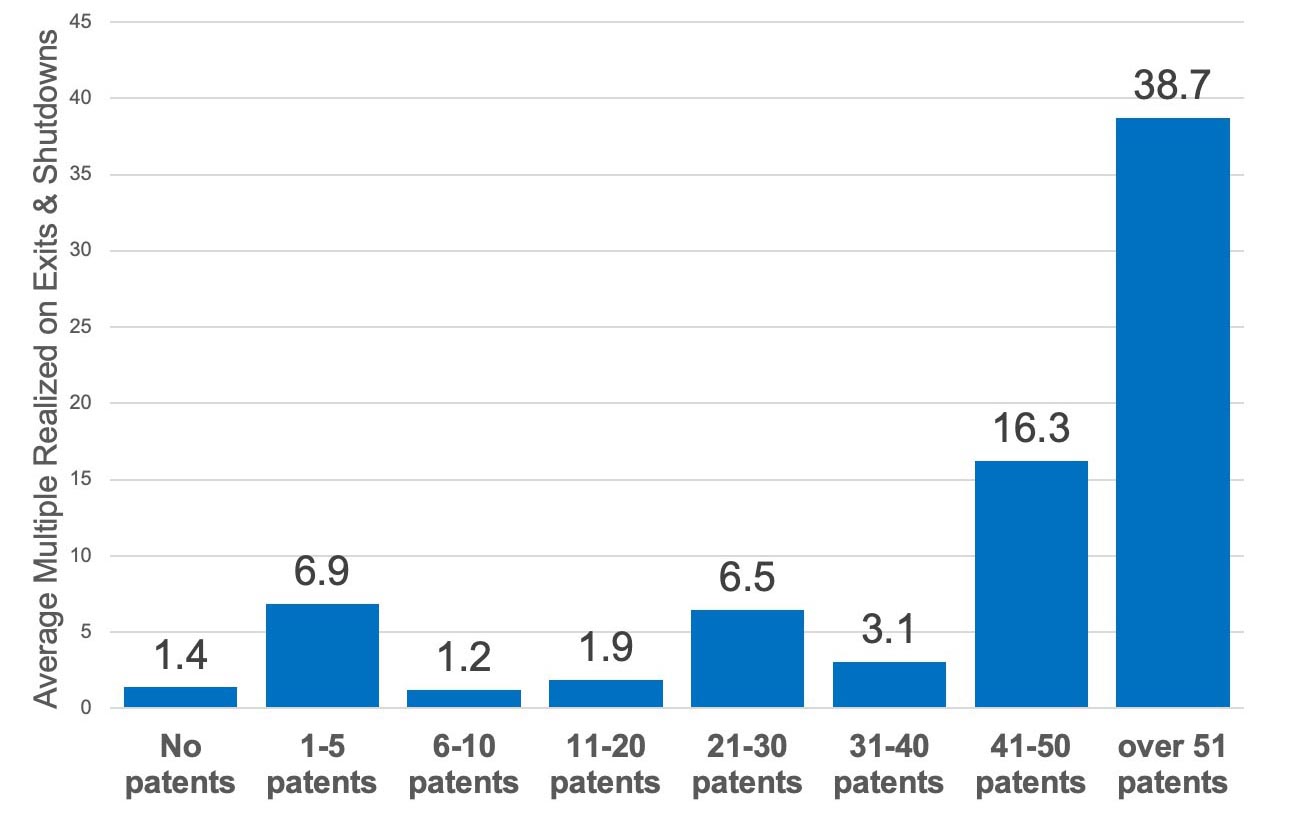

Portfolios of over 51 patents also are much more likely to lead to an exit than to a shutdown – those large patent portfolios are in 13% of exits but only 3% of shutdowns. But the importance of patents goes beyond the likelihood of an exit. Turning to the magnitude of the exit in terms of the multiple on the amount invested, TCA VG’s experience shows a compelling relationship between larger portfolios of patents and the magnitude of the exit multiple:

Figure 2: Patent Portfolio Strength Drives Returns

Source: Pitchbook (for patent info) and Analysis of TCA Venture Group Exits and Shutdowns 1997-2023

This relationship between size of the patent portfolio and outcome multiples is consistent and compelling:

Figure 3: Larger Exit Multiples More Patent Intensive

Source: Pitchbook (for patent info) and Analysis of TCA Venture Group portfolio 1997-2023

Looking at this data the other way, a robust patent portfolio drives larger exit multiples:

Figure 4: Stronger Patent Portfolio Drives Larger Exit Multiples

Source: Pitchbook (for patent info) and Analysis of TCA Venture Group portfolio 1997-2023

The importance of patents as a means to drive higher exits is evident in TCA VG’s six largest exits – all of which had patents and four of the six had large patent portfolios:

Figure 5: TCA VG’s Best Exits All Had Patents

Source: Pitchbook (for patent info) and Analysis of TCA Venture Group portfolio 1997-2023

This all makes a lot of sense. The presence of a patent portfolio is a strong incentive for being acquired, and even in the case of a failing company is more likely to lead to some sale of the patents for at least some residual value (which is still an “Exit”). There may also be a relationship between healthy margins and free cash flow and the size of the patent portfolio, because companies with marginal financials may not be able to afford building a large patent portfolio; those healthy margins may be due to the barriers of patentable product differentiation, or it may be for other reasons.

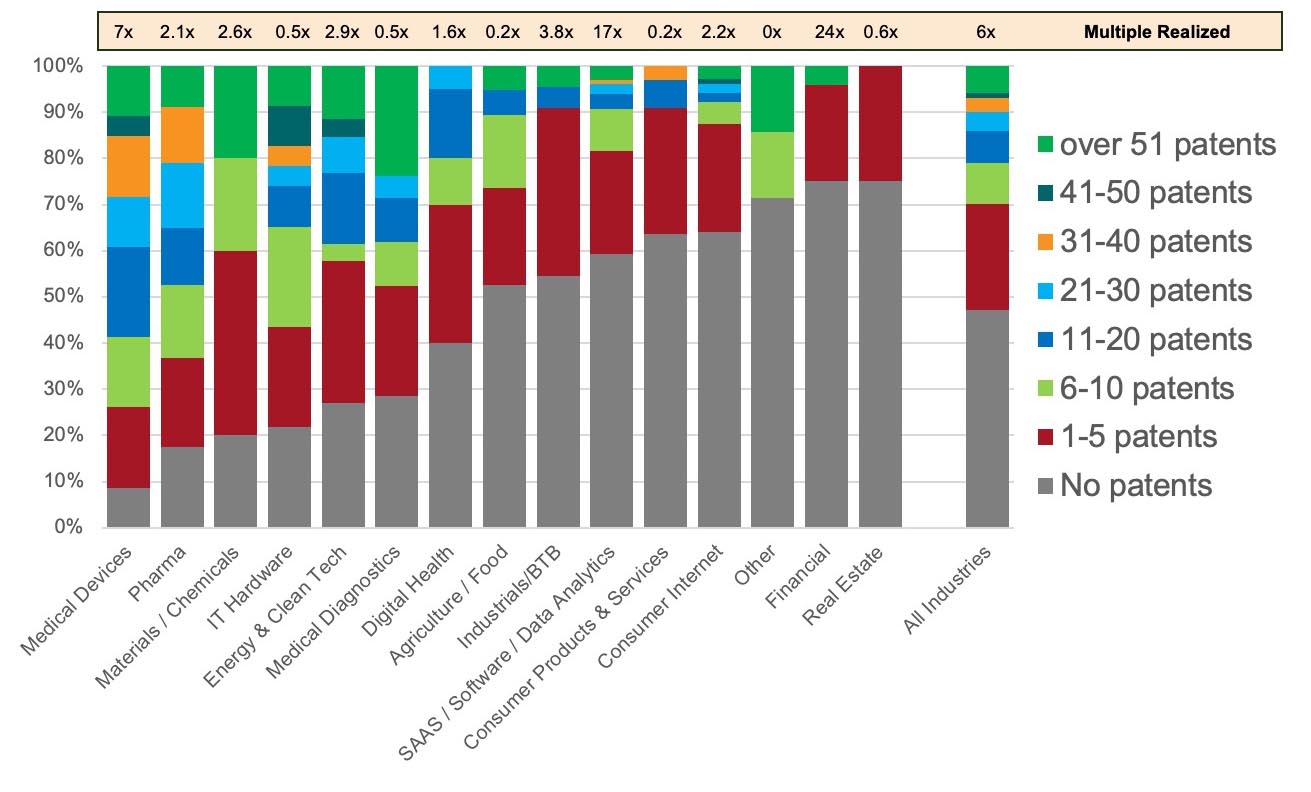

Obviously, patents vary in importance across industry verticals, although there is not a direct correlation between patent intensity of an industry and the overall return TCA VG has realized in various industries. That overall return is driven by a few home runs (or lack thereof), so even a vertical industry light on patents such as financial services can have a high overall return of 24x because the big home run of Green Dot in prepaid credit cards beat out 17 other competitors through better execution instead of the strength of their one patent – and realized a 235x return! In Life Sciences (medical devices, pharma, medical diagnostics and digital health) exits are exceedingly rare without a healthy patent portfolio, In other industries such as consumer products, real estate and agriculture/food any lack of barriers to competition (in the form of patents) becomes a big factor in the low returns:

Figure 6: Patent Intensity By Vertical

Takeaways

All other things being equal, patents increase a likelihood of an exit, and the size of the patent portfolio tends to also lead to larger exits. While it is certainly possible to achieve an attractive exit without patents, the odds of doing so are less.